The Global Impact of U.S. Tariff Policies: Repercussions and Consequences for the International Community

Keywords:

Global Economic Impact, Stock Market Downturns, Inflationary Pressures, Long-Term Economic Stability, Financial Data Analysis, European Union, U.S. Dollar DepreciationAbstract

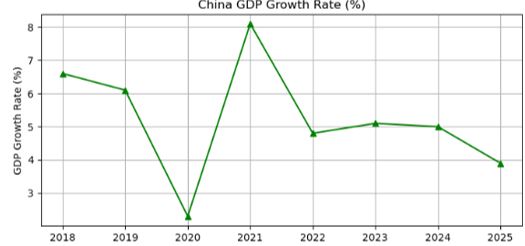

This paper examines the far-reaching consequences of the 2025 U.S. tariff policy under the Trump administration, which imposed a universal 10% tariff on all imported goods. The research explores the multidimensional impacts of this policy shift, including stock market downturns in Asia, volatility in commodity prices such as gold, and significant depreciation of the U.S. dollar against major currencies. It further analyzes disruptions in global supply chains, increased inflationary pressures, and the specter of stagflation in both developed and emerging economies. Retaliatory tariffs from key trading partners, including China and the European Union, reveal a growing tendency toward economic nationalism and rising global protectionism. The study draws on real-time financial data, policy statements, and economic indicators to present a nuanced view of how aggressive trade strategies by a global hegemon can reshape international economic relations, potentially triggering global recessionary trends. Findings suggest that such policies may offer short-term leverage but pose serious risks to long-term global economic stability and cooperation.