Volatility Prediction in Cryptocurrency Using NFTs

Keywords:

Cryptocurrency, Machine Learning, NFT, Price Prediction, Volatility.Abstract

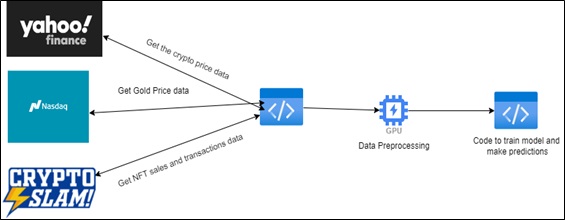

The cryptocurrency market has evolved in unprecedented ways over the past decade. However, due to the high price volatility associated with cryptocurrencies, predicting their prices remains an attractive research topic. While many researchers have focused on predicting cryptocurrency prices, there has been relatively little attention given to the latest trend in blockchain applications, specifically non-fungible tokens (NFTs). In this study, we have prepared a dataset comprising NFT sales and transaction data, along with information from other cryptocurrencies. This dataset is utilized to forecast the future price of Bitcoin using several machines learning models, including Linear Regression, Random Forest, and XG Boost. The results highlight the prediction accuracy of these models. Among the three, the Random Forest regressor demonstrates the highest accuracy, followed closely by the XG Boost regressor and Linear Regression. These findings may assist investors in making informed decisions when investing in cryptocurrencies.

References

A. F. M. Shahen Shah, Muhammet Ali Karabulut, A. F. M. Suaib Akhter, Nazifa Mustari, Al-Sakib Khan Pathan, Khaled M. Rabie, and Thokozani Shongwe. On the vital aspects and characteristics of cryptocurrency—a survey. IEEE Access, 11:9451–9468, 2023.

Azim Fahmi, Noor Samsudin, Aida Mustapha, Nazim Razali, and Shamsul Kamal Ahmad Khalid. Regression based analysis for bitcoin price prediction. International Journal of Engineering Technology, 7:1070, 12 2018.

Karunya Rathan, Somarouthu Venkat Sai, and Tubati Sai Manikanta. Crypto-currency price prediction using decision tree and regression techniques. In 2019 3rd International Conference on Trends in Electronics and Informatics (ICOEI), pages 190–194. IEEE, 2019.

Mauro Conti, E Sandeep Kumar, Chhagan Lal, and Sushmita Ruj. A survey on security and privacy issues of bitcoin. IEEE communications surveys & tutorials, 20(4):3416–3452, 2018.

Hemendra Gupta and Rashmi Chaudhary. An empirical study of volatility in the cryptocurrency market. Journal of Risk and Financial Management, 15(11):513, 2022.

Rashika Bangroo, Utsav Gupta, Roshan Sah, and Anil Kumar. Cryptocurrency price prediction using machine learning algorithm. In 2022 10th International Conference on Reliability, Infocom Technologies and Optimization (Trends and Future Directions) (ICRITO), pages 1–4. IEEE, 2022.

N Ramya et al. Crypto-currency price prediction using machine learning. In 2022 6th International Conference on Trends in Electronics and Informatics (ICOEI), pages 1455–1458. IEEE, 2022.

Mareena Fernandes, Saloni Khanna, Leandra Monteiro, Anu Thomas, and Garima Tripathi. Bitcoin price prediction. In 2021 International Conference on Advances in Computing, Communication, and Control (ICAC3), pages 1–4, 2021.

Shruti Garg et al. Autoregressive integrated moving average model based prediction of bitcoin close price. In 2018 international conference on smart systems and inventive technology (ICSSIT), pages 473–478. IEEE, 2018.

Shaily Roy, Samiha Nanjiba, and Amitabha Chakrabarty. Bitcoin price forecasting using time series analysis. In 2018 21st International Conference of Computer and Information Technology (ICCIT), pages 1–5, 2018.

Otabek Sattarov, Heung Seok Jeon, Ryumduck Oh, and Jun Dong Lee. Forecasting bitcoin price fluctuation by twitter sentiment analysis. In 2020 International Conference on Information Science and Communications Technologies (ICISCT), pages 1–4. IEEE, 2020.

Muhammad Rizwan, Sanam Narejo, and Moazzam Javed. Bitcoin price prediction using deep learning algorithm. In 2019 13th International Conference on Mathematics, Actuarial Science, Computer Science and Statistics (MACS), pages 1– 7. IEEE, 2019.

Rahmat Albariqi and Edi Winarko. Prediction of bitcoin price change using neural networks. In 2020 international conference on smart technology and applications (ICoSTA), pages 1–4. IEEE, 2020.

Patel Jay, Vasu Kalariya, Pushpendra Parmar, Sudeep Tanwar, Neeraj Kumar, and Mamoun Alazab. Stochastic neural networks for cryptocurrency price prediction. Ieee access, 8:82804–82818, 2020.

MyungJae Shin, David Mohaisen, and Joongheon Kim. Bitcoin price forecasting via ensemble-based lstm deep learning networks. In 2021 International conference on information networking (ICOIN), pages 603–608. IEEE, 2021.

Zeinab Shahbazi and Yung-Cheol Byun. Improving the cryptocurrency price prediction performance based on reinforcement learning. IEEE Access, 9:162651–162659, 2021.

Sashank Sridhar and Sowmya Sanagavarapu. Multi-head self-attention transformer for dogecoin price prediction. In 2021 14th International Conference on Human System Interaction (HSI), pages 1–6. IEEE, 2021.

Basant Agarwal, Priyanka Harjule, Lakshit Chouhan, Upkar Saraswat, Himanshu Airan, and Parth Agarwal. Prediction of dogecoin price using deep learning and social media trends. EAI Endorsed Transactions on Industrial Networks and Intelligent Systems, 8(29):e2–e2, 2021.

YahooDeveloper. Yahoo developer api. https://developer.yahoo.com/api/, 2023. Accessed: 2023-05-22.

Cryptoslam. Cryptoslam. https://cryptoslam.io, 2023. Accessed: 2023-03-17.

Nasdaq. Nasdaq. https://nasdaq.com, 2023. Accessed: 2023-03-17.

Manolis C. Tsakiris, Liangzu Peng, Aldo Conca, Laurent Kneip, Yuanming Shi, and Hayoung Choi. An algebraic-geometric approach for linear regression without correspondences. IEEE transactions on Information Theory, 66(8):5130–5144, 2020.

Mira Jeong, Jaeyeal Nam, and Byoung Chul Ko. Lightweight multilayer random forests for monitoring driver emotional status. Ieee Access, 8:60344–60354, 2020.

Dahai Zhang, Liyang Qian, Baijin Mao, Can Huang, Bin Huang, and Yulin Si. A data-driven design for fault detection of wind turbines using random forests and xgboost. Ieee Access, 6:21020–21031, 2018.

Claude Sammut and Geoffrey I Webb. Encyclopedia of machine learning. Springer Science & Business Media, 2011.

Maaz Mahadi, Tarig Ballal, Muhammad Moinuddin, and Ubaid M Al-Saggaf. Portfolio

optimization using a consistent vector-based mse estimation approach. IEEE Access, 10:86636– 86646, 2022.

Mei Zheng, Fan Min, Heng-Ru Zhang, and Wen-Bin Chen. Fast recommendations with the m-distance. IEEE Access, 4:1464–1468, 2016.

Sang-Ha Sung, Jong-Min Kim, Byung-Kwon Park, and Sangjin Kim. A study on cryptocurrency log-return price prediction using multivariate time- series model. Axioms, 11(9):448, 2022.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 50sea

This work is licensed under a Creative Commons Attribution 4.0 International License.