Use of Artificial Intelligence in Ethereum Forecasting: The Deep Learning Models RNN and CNN with Ensemble Averaging Technique

Keywords:

LSTM (Long short-term memory), CNN (Convolutional Neural Network), RNN (Recurrent Neural network, Ensemble learning, Deep learningAbstract

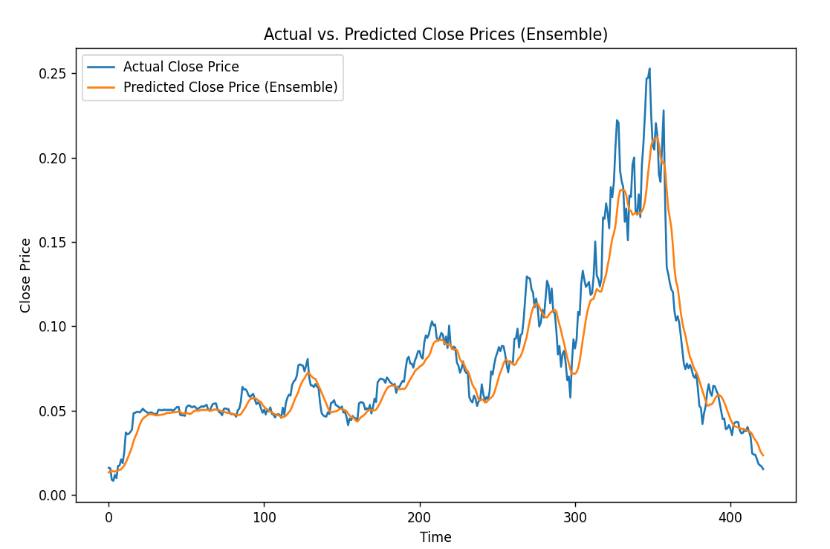

In the fast-evolving cryptocurrency market, accurately predicting Ethereum prices is crucial for investors, traders, and financial analysts. Traditional machine learning (ML) models often struggle to capture the market's complex dynamics due to their inability to consider all influencing factors. This study introduces an advanced ensemble machine learning approach to enhance Ethereum price prediction accuracy. By combining the strengths of Bi-directional Long Short-Term Memory (Bi-LSTM) and Convolutional Neural Network (CNN) models, our ensemble averaging method compensates for individual model weaknesses, improving forecast reliability and precision. Results show that our ensemble model offers significant advantages, particularly in terms of generalizability and resistance to overfitting with LSTM and CNN models and this technique is offering a more effective tool for navigating cryptocurrency market complexities. This research highlights the importance of ensemble learning in financial forecasting and provides a practical framework for developing superior predictive models. “Moreover, This study explores an advanced ensemble machine learning approach to enhance Ethereum price predictions, combining the strengths of Bi-directional Long Short-Term Memory (Bi-LSTM) and Convolutional Neural Network (CNN) models. While Bi-LSTM individually exhibits slightly higher performance in our tests, the ensemble method demonstrates enhanced stability and reliability, making it a valuable tool for navigating the unpredictable dynamics of the cryptocurrency market. We found that Bi-LSTM is good on its own, but the balanced approach of the ensemble model is far better, especially when it comes to generalizability and overfitting resistance. Insights into creating flexible and trustworthy prediction models are provided by this study, which highlights the possibilities of ensemble learning in financial forecasting.

References

M. Saad, J. Choi, D. Nyang, J. Kim, and A. Mohaisen, “Toward characterizing blockchain-based cryptocurrencies for highly accurate predictions,” IEEE Syst. J., vol. 14, no. 1, pp. 321–332, Mar. 2020, doi: 10.1109/JSYST.2019.2927707.

J. Kim and J. Kim, “Demo: Light-weight programming language for blockchain,” MobiSys 2019 - Proc. 17th Annu. Int. Conf. Mob. Syst. Appl. Serv., pp. 653–654, Jun. 2019, doi: 10.1145/3307334.3328567.

M. Saad, L. Njilla, C. Kamhoua, J. Kim, D. Nyang, and A. Mohaisen, “Mempool optimization for Defending Against DDoS Attacks in PoW-based Blockchain Systems,” ICBC 2019 - IEEE Int. Conf. Blockchain Cryptocurrency, pp. 285–292, May 2019, doi: 10.1109/BLOC.2019.8751476.

A. Einstein, B. Podolsky, and N. Rosen, “Can quantum-mechanical description of physical reality be considered complete?,” Phys. Rev., vol. 47, no. 10, pp. 777–780, May 1935, doi: 10.1103/PHYSREV.47.777/FIGURE/1/THUMB.

M. Umar, C. W. Su, S. K. A. Rizvi, and X. F. Shao, “Bitcoin: A safe haven asset and a winner amid political and economic uncertainties in the US?,” Technol. Forecast. Soc. Change, vol. 167, p. 120680, Jun. 2021, doi: 10.1016/J.TECHFORE.2021.120680.

“Box, G.E.P. and Jenkins, G.M. (1970) Time Series Analysis Forecasting and Control. Holden-Day, San Francisco. - References - Scientific Research Publishing.” Accessed: May 05, 2024. [Online]. Available: https://www.scirp.org/reference/referencespapers?referenceid=2087370

I. M. Wirawan, T. Widiyaningtyas, and M. M. Hasan, “Short Term Prediction on Bitcoin Price Using ARIMA Method,” Proc. - 2019 Int. Semin. Appl. Technol. Inf. Commun. Ind. 4.0 Retrosp. Prospect. Challenges, iSemantic 2019, pp. 260–265, Sep. 2019, doi: 10.1109/ISEMANTIC.2019.8884257.

P. T. Yamak, L. Yujian, and P. K. Gadosey, “A comparison between ARIMA, LSTM, and GRU for time series forecasting,” ACM Int. Conf. Proceeding Ser., pp. 49–55, Dec. 2019, doi: 10.1145/3377713.3377722.

S. Roy, S. Nanjiba, and A. Chakrabarty, “Bitcoin Price Forecasting Using Time Series Analysis,” 2018 21st Int. Conf. Comput. Inf. Technol. ICCIT 2018, Jul. 2018, doi: 10.1109/ICCITECHN.2018.8631923.

T. Walther, T. Klein, and E. Bouri, “Exogenous drivers of Bitcoin and Cryptocurrency volatility – A mixed data sampling approach to forecasting,” J. Int. Financ. Mark. Institutions Money, vol. 63, p. 101133, Nov. 2019, doi: 10.1016/J.INTFIN.2019.101133.

L. Maciel, “Cryptocurrencies value-at-risk and expected shortfall: Do regime-switching volatility models improve forecasting?,” Int. J. Financ. Econ., vol. 26, no. 3, pp. 4840–4855, Jul. 2021, doi: 10.1002/IJFE.2043.

J. C. Mba, S. M. Mwambi, and E. Pindza, “A Monte Carlo Approach to Bitcoin Price Prediction with Fractional Ornstein–Uhlenbeck Lévy Process,” Forecast. 2022, Vol. 4, Pages 409-419, vol. 4, no. 2, pp. 409–419, Mar. 2022, doi: 10.3390/FORECAST4020023.

V. Derbentsev, V. Babenko, K. Khrustalev, H. Obruch, and S. Khrustalova, “Comparative Performance of Machine Learning Ensemble Algorithms for Forecasting Cryptocurrency Prices,” Int. J. Eng., vol. 34, no. 1, pp. 140–148, Jan. 2021, doi: 10.5829/IJE.2021.34.01A.16.

J. Chevallier, D. Guégan, and S. Goutte, “Is It Possible to Forecast the Price of Bitcoin?,” Forecast. 2021, Vol. 3, Pages 377-420, vol. 3, no. 2, pp. 377–420, May 2021, doi: 10.3390/FORECAST3020024.

A. M. Khedr, I. Arif, P. V. Pravija Raj, M. El-Bannany, S. M. Alhashmi, and M. Sreedharan, “Cryptocurrency price prediction using traditional statistical and machine-learning techniques: A survey,” Intell. Syst. Accounting, Financ. Manag., vol. 28, no. 1, pp. 3–34, Jan. 2021, doi: 10.1002/ISAF.1488.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 50SEA

This work is licensed under a Creative Commons Attribution 4.0 International License.