HLCE: Framework for Enhanced Stock Price Forecasting

Keywords:

Stock Price Prediction, Hybrid LSTM-Conventional Ensemble (HLCE), Time Series Forecasting, Financial Forecasting, Forecasting AccuracyAbstract

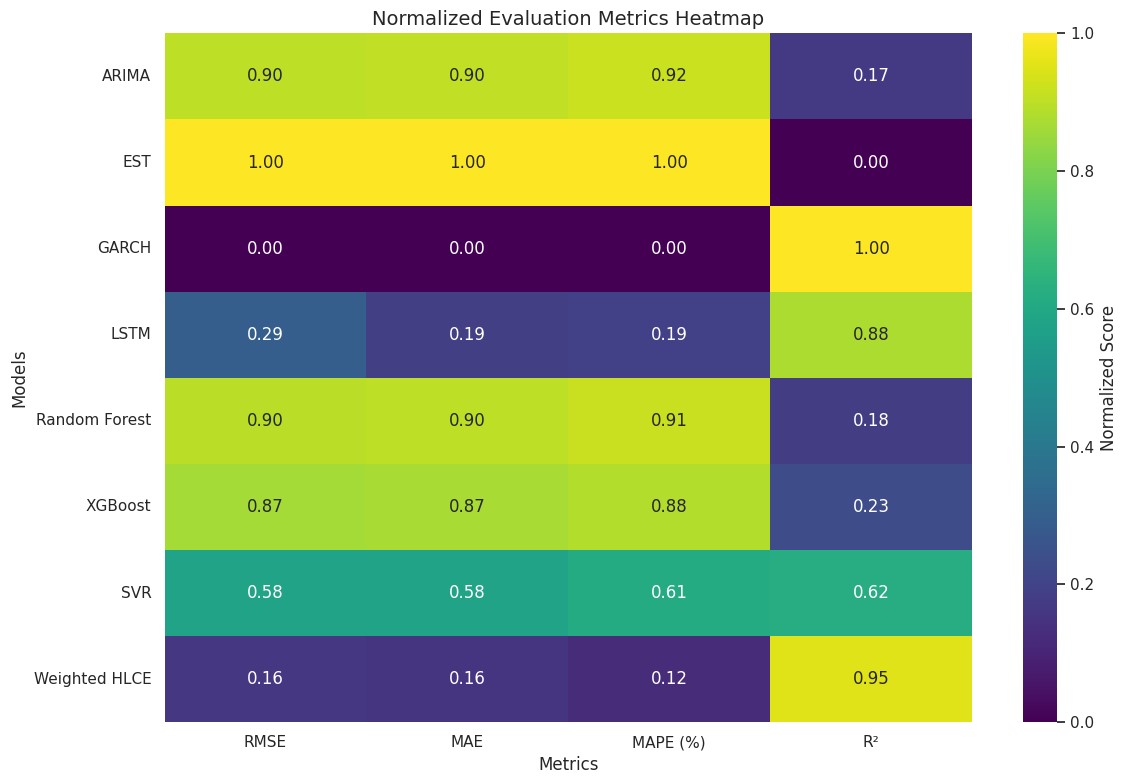

Accurate stock price forecasting is a key element of risk management and investment decision-making. A key element of this study is the introduction of a Hybrid LSTM-Conventional Ensemble (HLCE) model, which addresses the limitations of traditional models in capturing nonlinear financial patterns. Utilizing the advantages of both deep learning and conventional forecasting techniques, the HLCE framework combines Long Short-Term Memory (LSTM) networks with traditional statistical models and machine learning methods, including Random Forest, XGBoost, and Support Vector Regression (SVR). The model is assessed using important performance metrics, such as Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), Mean Absolute Percentage Error (MAPE), and R-squared (R²), in a case study using Apple Inc. (AAPL) stock data, where MinMaxScaler is utilized for data preprocessing. With an RMSE of 0.16, MAE of 0.16, MAPE of 0.12%, and R² of 0.95, the HLCE model performs better than individual models, according to experimental results, demonstrating its greater capacity to identify intricate financial patterns. By contrast, isolated models exhibit far lower predictive efficiency and much higher error rates. These results highlight the promise of ensemble and hybrid approaches in financial forecasting, offering a more reliable and accurate framework for predicting stock prices. The work adds to the expanding body of research supporting the combination of deep learning and conventional techniques to enhance risk assessment and financial market analysis.

References

M. Khashei, M. Bijari, and S. R. Hejazi, “Combining seasonal ARIMA models with computational intelligence techniques for time series forecasting,” Soft Comput., vol. 16, no. 6, pp. 1091–1105, Jun. 2012, doi: 10.1007/S00500-012-0805-9/METRICS.

E. S. Gardner, “Exponential smoothing: The state of the art—Part II,” Int. J. Forecast., vol. 22, no. 4, pp. 637–666, Oct. 2006, doi: 10.1016/J.IJFORECAST.2006.03.005.

M. Gan, Y. Cheng, K. Liu, and G. L. Zhang, “Seasonal and trend time series forecasting based on a quasi-linear autoregressive model,” Appl. Soft Comput., vol. 24, pp. 13–18, Nov. 2014, doi: 10.1016/J.ASOC.2014.06.047.

M. F. Omran and E. McKenzie, “Heteroscedasticity in stock returns data revisited: volume versus GARCH effects,” Appl. Financ. Econ., vol. 10, no. 5, pp. 553–560, Sep. 2000, doi: 10.1080/096031000416433.

H. jung Kim and K. shik Shin, “A hybrid approach based on neural networks and genetic algorithms for detecting temporal patterns in stock markets,” Appl. Soft Comput., vol. 7, no. 2, pp. 569–576, Mar. 2007, doi: 10.1016/J.ASOC.2006.03.004.

A. Kanas, “Non-linear forecasts of stock returns,” J. Forecast., vol. 22, no. 4, pp. 299–315, Jul. 2003, doi: 10.1002/FOR.858.

S. Siami-Namini, N. Tavakoli, and A. S. Namin, “The Performance of LSTM and BiLSTM in Forecasting Time Series,” Proc. - 2019 IEEE Int. Conf. Big Data, Big Data 2019, pp. 3285–3292, Dec. 2019, doi: 10.1109/BIGDATA47090.2019.9005997.

et al Li, S., “Stock price prediction based on LSTM deep learning model with attention mechanism,” IEEE Access, vol. 10, pp. 23743–23751, 2022.

A. Q. Md et al., “Novel optimization approach for stock price forecasting using multi-layered sequential LSTM,” Appl. Soft Comput., vol. 134, p. 109830, Feb. 2023, doi: 10.1016/J.ASOC.2022.109830.

X. Zhang, X. Liang, A. Zhiyuli, S. Zhang, R. Xu, and B. Wu, “AT-LSTM: An Attention-based LSTM Model for Financial Time Series Prediction,” IOP Conf. Ser. Mater. Sci. Eng., vol. 569, no. 5, Aug. 2019, doi: 10.1088/1757-899X/569/5/052037.

C. Ubal, G. Di-Giorgi, J. E. Contreras-Reyes, and R. Salas, “Predicting the Long-Term Dependencies in Time Series Using Recurrent Artificial Neural Networks,” Mach. Learn. Knowl. Extr. 2023, Vol. 5, Pages 1340-1358, vol. 5, no. 4, pp. 1340–1358, Oct. 2023, doi: 10.3390/MAKE5040068.

Y. Liu, C. Gong, L. Yang, and Y. Chen, “DSTP-RNN: A dual-stage two-phase attention-based recurrent neural network for long-term and multivariate time series prediction,” Expert Syst. Appl., vol. 143, p. 113082, Apr. 2020, doi: 10.1016/J.ESWA.2019.113082.

J. Sen and S. Mehtab, “Long‐and‐Short‐Term Memory (LSTM) NetworksArchitectures and Applications in Stock Price Prediction,” Emerg. Comput. Paradig., pp. 143–160, Jul. 2022, doi: 10.1002/9781119813439.CH8.

A. Parmar, R. Katariya, and V. Patel, “A Review on Random Forest: An Ensemble Classifier,” Lect. Notes Data Eng. Commun. Technol., vol. 26, pp. 758–763, 2019, doi: 10.1007/978-3-030-03146-6_86.

A. Basudhar and S. Missoum, “Local update of support vector machine decision boundaries,” Collect. Tech. Pap. - AIAA/ASME/ASCE/AHS/ASC Struct. Struct. Dyn. Mater. Conf., 2009, doi: 10.2514/6.2009-2189;PAGE:STRING:ARTICLE/CHAPTER.

J. Hamidzadeh and S. Moslemnejad, “Identification of uncertainty and decision boundary for SVM classification training using belief function,” Appl. Intell., vol. 49, no. 6, pp. 2030–2045, Jun. 2019, doi: 10.1007/S10489-018-1374-0/METRICS.

I. Ali, J., Khan, R., Ahmad, N., & Maqsood, “Random Forests and Decision Trees,” International Journal of Computer Science Issues (IJCSI). Accessed: Apr. 26, 2025. [Online]. Available: https://www.researchgate.net/publication/259235118_Random_Forests_and_Decision_Trees

H. A. Salman, A. Kalakech, and A. Steiti, “Random Forest Algorithm Overview,” Babylonian J. Mach. Learn., vol. 2024, pp. 69–79, Jun. 2024, doi: 10.58496/BJML/2024/007.

R. E. Banfield, L. O. Hall, K. W. Bowyer, and W. P. Kegelmeyer, “A comparison of decision tree ensemble creation techniques,” IEEE Trans. Pattern Anal. Mach. Intell., vol. 29, no. 1, pp. 173–180, Jan. 2007, doi: 10.1109/TPAMI.2007.250609.

J. Kuvulmaz, S. Usanmaz, and S. N. Engin, “Time-Series Forecasting by Means of Linear and Nonlinear Models,” Lect. Notes Comput. Sci. (including Subser. Lect. Notes Artif. Intell. Lect. Notes Bioinformatics), vol. 3789 LNAI, pp. 504–513, 2005, doi: 10.1007/11579427_51.

U. M. Sirisha, M. C. Belavagi, and G. Attigeri, “Profit Prediction Using ARIMA, SARIMA and LSTM Models in Time Series Forecasting: A Comparison,” IEEE Access, vol. 10, pp. 124715–124727, 2022, doi: 10.1109/ACCESS.2022.3224938.

H. Pan, Y. Tang, and G. Wang, “A Stock Index Futures Price Prediction Approach Based on the MULTI-GARCH-LSTM Mixed Model,” Math. 2024, Vol. 12, Page 1677, vol. 12, no. 11, p. 1677, May 2024, doi: 10.3390/MATH12111677.

A. García-Medina and E. Aguayo-Moreno, “LSTM–GARCH Hybrid Model for the Prediction of Volatility in Cryptocurrency Portfolios,” Comput. Econ., vol. 63, no. 4, pp. 1511–1542, Apr. 2024, doi: 10.1007/S10614-023-10373-8/METRICS.

H. Mehtarizadeh, N. Mansouri, B. Mohammad Hasani Zade, and M. M. Hosseini, “Stock price prediction with SCA-LSTM network and Statistical model ARIMA-GARCH,” J. Supercomput. 2025 812, vol. 81, no. 2, pp. 1–49, Jan. 2025, doi: 10.1007/S11227-024-06775-6.

H. Li, Y. Shen, and Y. Zhu, “Stock Price Prediction Using Attention-based Multi-Input LSTM,” Nov. 04, 2018, PMLR. Accessed: Apr. 26, 2025. [Online]. Available: https://proceedings.mlr.press/v95/li18c.html

D. Song and D. Song, “Stock Price Prediction based on Time Series Model and Long Short-term Memory Method,” Highlights Business, Econ. Manag., vol. 24, pp. 1203–1210, Jan. 2024, doi: 10.54097/E75XGK49.

D. S. O. L. O. R. U. N. F. E. M. I. Adams, “Asymmetric GARCH Type Models and LSTM for Volatility Characteristics Analysis of Nigeria Stock Exchange Returns,” Am. J. Math. Stat. , Jan. 2024, doi: 10.5923/J.AJMS.20241402.01.

K. Xu, Y. Wu, M. Jiang, W. Sun, and Z. Yang, “Hybrid LSTM-GARCH Framework for Financial Market Volatility Risk Prediction,” J. Comput. Sci. Softw. Appl., vol. 4, no. 5, pp. 22–29, Sep. 2024, doi: 10.5281/ZENODO.13643010.

J. Qiu, B. Wang, and C. Zhou, “Forecasting stock prices with long-short term memory neural network based on attention mechanism,” PLoS One, vol. 15, no. 1, p. e0227222, Jan. 2020, doi: 10.1371/JOURNAL.PONE.0227222.

J. Zhang and Y. Liu, “SVM decision boundary based discriminative subspace induction,” Pattern Recognit., vol. 38, no. 10, pp. 1746–1758, Oct. 2005, doi: 10.1016/J.PATCOG.2005.01.016.

A. Kurani, P. Doshi, A. Vakharia, and M. Shah, “A Comprehensive Comparative Study of Artificial Neural Network (ANN) and Support Vector Machines (SVM) on Stock Forecasting,” Ann. Data Sci., vol. 10, no. 1, pp. 183–208, Feb. 2023, doi: 10.1007/S40745-021-00344-X/METRICS.

A. Lendasse, E. de Bodt, V. Wertz, and M. Verleysen, “Non-linear financial time series forecasting - Application to the Bel 20 stock market index,” Eur. J. Econ. Soc. Syst., vol. 14, no. 1, pp. 81–91, 2000, doi: 10.1051/EJESS:2000110.

W. Bao, J. Yue, and Y. Rao, “A deep learning framework for financial time series using stacked autoencoders and long-short term memory,” PLoS One, vol. 12, no. 7, p. e0180944, Jul. 2017, doi: 10.1371/JOURNAL.PONE.0180944.

A. H. Bukhari, M. A. Z. Raja, M. Sulaiman, S. Islam, M. Shoaib, and P. Kumam, “Fractional neuro-sequential ARFIMA-LSTM for financial market forecasting,” IEEE Access, vol. 8, pp. 71326–71338, 2020, doi: 10.1109/ACCESS.2020.2985763.

K. A. Althelaya, E. S. M. El-Alfy, and S. Mohammed, “Evaluation of Bidirectional LSTM for Short and Long-Term Stock Market Prediction,” 2018 9th Int. Conf. Inf. Commun. Syst. ICICS 2018, vol. 2018-January, pp. 151–156, May 2018, doi: 10.1109/IACS.2018.8355458.

M. Beniwal, A. Singh, and N. Kumar, “Forecasting multistep daily stock prices for long-term investment decisions: A study of deep learning models on global indices,” Eng. Appl. Artif. Intell., vol. 129, Mar. 2024, doi: 10.1016/J.ENGAPPAI.2023.107617;REQUESTEDJOURNAL:JOURNAL:EAAI;WGROUP:STRING:ACM.

S. Chen and L. Ge, “Exploring the attention mechanism in LSTM-based Hong Kong stock price movement prediction,” Quant. Financ., vol. 19, no. 9, pp. 1507–1515, 2019, doi: 10.1080/14697688.2019.1622287;CSUBTYPE:STRING:SPECIAL;PAGE:STRING:ARTICLE/CHAPTER.

H. Han et al., “Time series forecasting model for non-stationary series pattern extraction using deep learning and GARCH modeling,” J. Cloud Comput., vol. 13, no. 1, pp. 1–19, Dec. 2024, doi: 10.1186/S13677-023-00576-7/FIGURES/10.

et al Ouahilal, M., “A comparative study of stock price prediction models based on machine learning techniques,” SN Comput. Sci., vol. 2, no. 1, pp. 1–12, 2024.

et al Liu, B., “Stock movement prediction from news articles with transfer learning,” Procedia Comput. Sci., vol. 179, pp. 768–776, 2021.

et al Huang, W., “A novel forecasting model of stock price movement based on multiple time-series indicators,” IEEE Access, vol. 8, pp. 69712–69722, 2020.

et al Takahashi, S., “Modeling and prediction of stock prices by generative adversarial networks,” IEICE Trans. Inf. Syst., vol. 102, no. 5, pp. 907–915, 2019.

et al Wang, Y., “Stock price prediction with GAN-based data augmentation,” Appl. Soft Comput., vol. 117, p. 108452, 2022.

M. Qiu and Y. Song, “Predicting the Direction of Stock Market Index Movement Using an Optimized Artificial Neural Network Model,” PLoS One, vol. 11, no. 5, p. e0155133, May 2016, doi: 10.1371/JOURNAL.PONE.0155133.

et al. Kumari, J., “Towards enhanced stock prediction using event-driven LSTM networks,” Inf. Syst. Front., pp. 1–16, 2023.

et al. Sohangir, S., “Big data composite representation and optimization using a hybrid model of a deep autoencoder and eigenvalue decomposition.,” IEEE Trans. Knowl. Data Eng., vol. 30, no. 9, pp. 1772–1779.

et al. Lim, B., “Temporal convolutional networks for stock price prediction.,” Mach. Learn. with Appl., vol. 8, p. 100080, 2019.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 50sea

This work is licensed under a Creative Commons Attribution 4.0 International License.