Monitoring the Spatial Structure of Land Values in Lahore Metropolitan Area

DOI:

https://doi.org/10.33411/ijist/2020020405Keywords:

Land values per Marla, Central Business District Lahore, Accuracy Assessment, Correlation Coefficient , Interpolation.Abstract

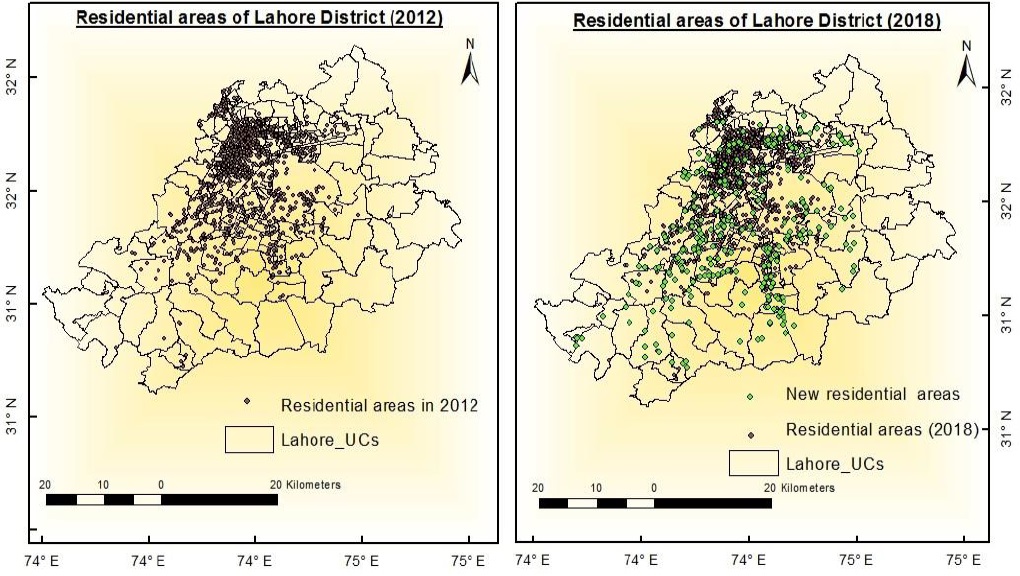

Spatio-temporal variations in assessment of land values play a vital role in better urban planning and policy making. This study focuses on spatial structures of land values in Lahore metropolitan area by using different spatial and statistical techniques. The comparative analysis of land values for the years 2012 & 2018 is generated which is useful for planners, investors, and policy makers. The research is descriptive but explanatory in nature to show correlation between independent variables (real land values) and dependent variables (interpolated land values). The interpolation techniques which have the highest correlation coefficient, were used further processing. The inter category shift based on interpolation maps for comparison shows categorical shift which is useful for investors in future. The results indicate that the land values are higher in Central Business District and Gulberg Zone because of highly active business zone which increases the demand of the land which is ultimately increasing the value of land in Lahore metropolitan area.

References

Shamshad, A. (2004). Spatial distribution of land values in Karachi city (Doctoral dissertation, University of Karachi).

Dziauddin, M. F., & Misran, M. (2016). Does Accessibility to the Central Business District (CBD) Have an Impact on High-Rise Condominium Price Gradient in Kuala Lumpur, Malaysia?. In SHS Web of Conferences (Vol. 23, p. 02004). EDP Sciences.

Jordaan, A. C., Drost, B. E., & Makgata, M. A. (2004). Land value as a function of distance from the CBD: the case of the eastern suburbs of Pretoria. South African Journal of Economic and Management Sciences, 7(3), 532-541.

Colwell, P. F., & Munneke, H. J. (2009). Directional land value gradients. The Journal of Real Estate Finance and Economics, 39(1), 1-23.

Van Bergeijk, P. A., & Murshed, S. (2012). The relation between land price and distance to CBD in Bekasi. Master's thesis. Erasmus University, Rotterdam.

Topccedil, M. (2009). Accessibility effect on urban land values. Scientific Research and Essays, 4(11), 1286-1291.

Albouy, D., Ehrlich, G., & Shin, M. (2018). Metropolitan land values. Review of Economics and Statistics, 100(3), 454-466.

Kahraman, E. D., & Kubat, A. S. (2015). In the effects of accessibility factors on land values in the CBD of Izmir. In Proceedings of the 10th international space syntax symposium (pp. 92-1)

Mirza, A. I., Mayo, S. M., Aziz, A., & Sharif, M. B. (2013). Spatial-Temporal Variations of Nitrogen Dioxide in and Around Lahore Metropolitan Areas Using “GIS” Techniques. Pakistan Journal of Science, 65(3), 371.

GOP The Urban Unit Lahore. Shape files of Lahore.

GOP Deputy Commissioner Office (2019, March 14). Value of immoveable properties. Pakistan.

GOP Fedral Senior Member Board of Revenue. (2018, December 18). Value of immoveable properties. Pakistan.

Colwell, P. F., & Munneke, H. J. (1999). Land prices and land assembly in the CBD. The Journal of Real Estate Finance and Economics, 18(2), 163-180.

Albouy, D., & Ehrlich, G. (2015, January). The distribution of urban land values: Evidence from market transactions. In Proceedings. Annual Conference on Taxation and Minutes of the Annual Meeting of the National Tax Association (Vol. 108, pp. 1-32). National Tax Association.

Costello, G. (2014). Land price dynamics in a large Australian urban housing market. International journal of housing markets and analysis.

Grimes, A., & Liang, Y. (2007). Spatial Determinants of Land Prices in Auckland: Does the metropolitan urban limit have an effect?. Available at SSRN 1005565.

Hui, E. C., & Liang, C. (2016). Spatial spillover effect of urban landscape views on property price. Applied geography, 72, 26-35.

Kim, J., & Zhang, M. (2005). Determining transit’s impact on Seoul commercial land values: An application of spatial econometrics. International Real Estate Review, 8(1), 1- 26.

Lee, Y. P. (2002). Determinants of Singapore residential land value (Doctoral dissertation, Massachusetts Institute of Technology).

[17] Ozus, E. (2009). Determinants of office rents in the Istanbul metropolitan area. European Planning Studies, 17(4), 621-633.

Qin, Y., Zhu, H., & Zhu, R. (2016). Changes in the distribution of land prices in urban China during 2007–2012. Regional Science and Urban Economics, 57, 77-90.

Rose, L. A. (1992). Land values and housing rents in urban Japan. Journal of Urban Economics, 31(2), 230-251.

Sampathkumar, V., Santhi, M. H., & Vanjinathan, J. (2015). Forecasting the land price using statistical and neural network software. Procedia Computer Science, 57, 112-121.

Thakur, S., & Choi, M. J. (2012). Characteristics of land value variation and the urban land market in Kathmandu, Nepal. International Journal of Urban Sciences, 16(1), 49-61.

Wizor, C. H., & Arokoyu, S. B. Determinants of Land Value in the University of Port Harcourt Host Communities, Nigeria.

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 50Sea

This work is licensed under a Creative Commons Attribution 4.0 International License.