Credit Card Fraud Detection Using Machine Learning with Undersampling and SMOTE Oversampling

Keywords:

Credit Card Fraud Detection, Machine Learning, SMOTE, Random Forest, Class Imbalance, Ensemble Methods., IoT Attacks, IoT Anomalies, Random Under Sampling, Machine LearningAbstract

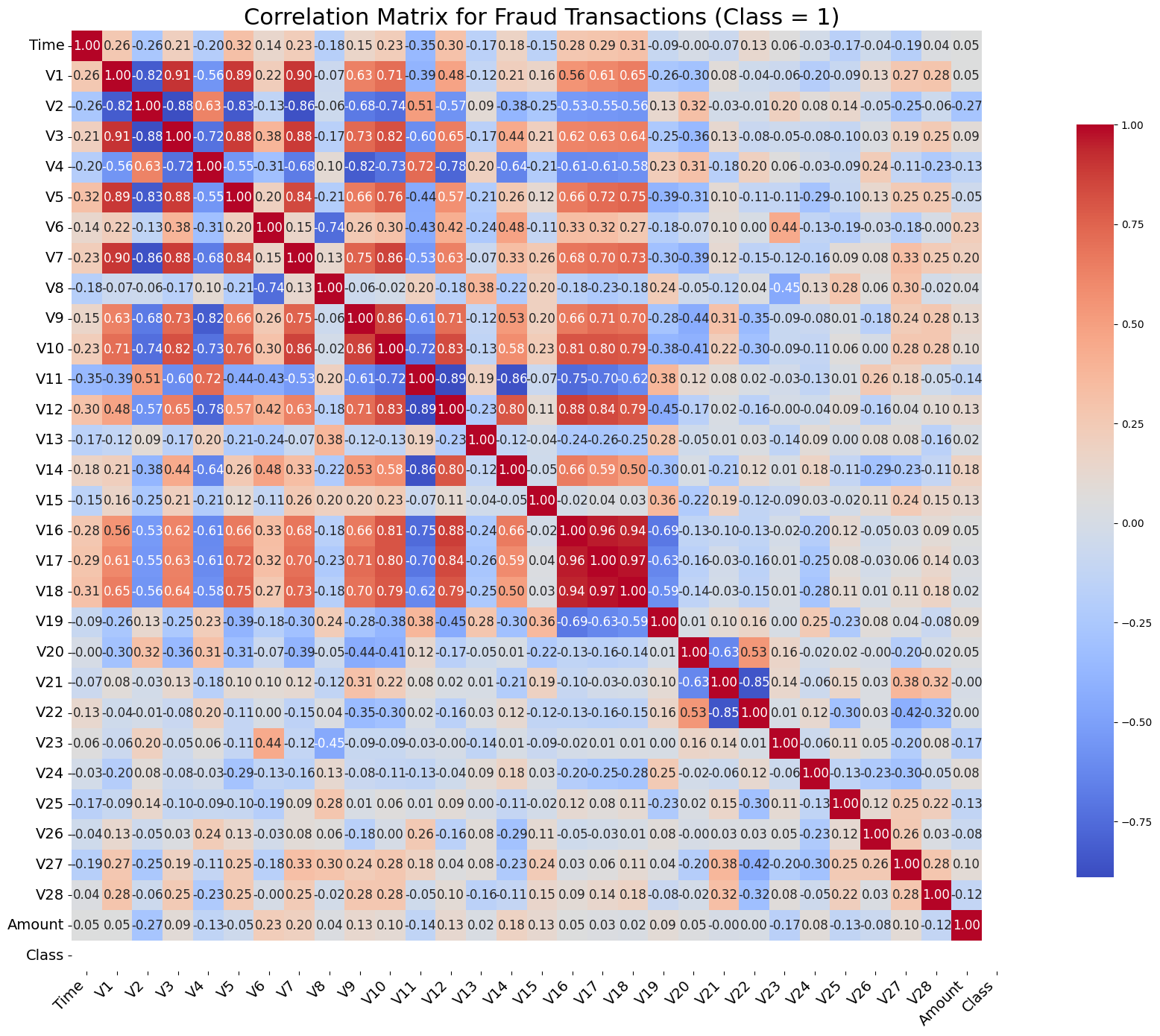

Credit card fraud detection is currently the most popular implementation domain of Computational Intelligence techniques. A common issue in the present world is being faced by many organizations and institutions. This is due to the increase in the frequency of transactions, which are now conducted electronically and a higher increase in the number of electronic commerce platforms. In the present world, we are experiencing many credit card issues. In this paper, we apply various algorithms of machine learning as random forest, logistic regression and k-Nearest Neighbors (KNN) to train the specified machine learning model using a given dataset to design the comparative conducted on the accuracy and various measures of the models as it is being implemented via each of such algorithms. To address this, we evaluate the possibility of under-sampling and SMOTE as approaches that can enhance multiple machine-learning models. An accuracy of 99.99% in the dataset was achieved using the SMOTE technique with the Random Forest model. This research concludes that SMOTE improves the performance of the machine learning model for fraud identification and presents a more efficient approach to address the problem of class imbalance.

References

J. Zhou, Y., Li, H., Sun, “Sequential transaction analysis for fraud detection using deep learning,” IEEE Trans. Knowl. Data Eng., vol. 33, no. 4, pp. 1024–1035, 2021.

D. Nguyen, T., Tran, P., Pham, “Ensemble learning for credit card fraud detection: A comparative study,” J. Financ. Data Sci., vol. 6, no. 2, pp. 89–101, 2022.

Z. Khan, I., Ali, M., Rehman, “Addressing class imbalance in credit card fraud detection with adaptive cost-sensitive learning,” J. Artif. Intell. Res., vol. 74, pp. 354–367, 2022.

F. Wang, X., Liu, Y., Zhang, “Comparative analysis of class balancing techniques in credit card fraud detection,” Data Sci. Anal., vol. 9, no. 3, pp. 221–235, 2023.

R. Patel, V., Singh, “Cluster-based undersampling for enhanced credit card fraud detection,” Int. J. Mach. Learn. Cybern., vol. 12, no. 9, pp. 2467–2480, 2021.

R. Liu, X., Chen, Q., Wong, “Dynamic data reduction in imbalanced datasets for fraud detection,” IEEE Access, vol. 11, pp. 101456–101469, 2023.

Y. Chen, L., Zhang, “SMOTE-ENN: A novel hybrid oversampling method for credit card fraud detection,” Expert Syst. Appl., vol. 193, 2022.

W. Gao, Y., Huang, S., Ma, “GAN-based oversampling for imbalanced credit card fraud detection,” J. Mach. Learn. Res., vol. 24, no. 1, pp. 567–586, 2023.

L. Yang, Z., He, C., Wang, “Hybrid sampling strategies for credit card fraud detection using machine learning,” Comput. Secur., vol. 114, 2022.

J. Kim, S., Lee, “An ensemble approach to credit card fraud detection using hybrid sampling methods,” J. Financ. Technol., vol. 13, no. 1, pp. 56–69, 2024.

“https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.javatpoint.com.” Accessed: Oct. 07, 2024. [Online]. Available: https://www.google.com/search?q=%5B14%5D+https%3A%2F%2Fwww.google.com

Y. Zhang, X., Chen, J., Ye, “An optimized decision tree-based credit card fraud detection system,” J. Financ. Risk Manag., vol. 15, no. 2, pp. 85–99, 2022.

A. Nguyen, H. T., Seifoddini, “Improving credit card fraud detection with decision trees,” Int. J. Data Sci., vol. 6, no. 3, pp. 122–136, 2023.

Z. Chen, R., Yin, “Comparative analysis of Naive Bayes models for credit card fraud detection,” J. Mach. Learn. Res., vol. 24, no. 4, pp. 1012–1030, 2023.

“PAB-1024x1024.png (1024×1024).”

V. N. Nguyen, T. H., Huynh, “Application of logistic regression in credit card fraud detection,” J. Financ. Anal., vol. 12, no. 3, pp. 120–135, 2021.

“Logistic regression - Wikipedia.”

N. V. Chawla, K. W. Bowyer, L. O. Hall and W. P. Kegelmeyer, “SMOTE: Synthetic Minority Over-sampling Technique,” J. Artif. Intell. Res., vol. 16, pp. 321–357, Jun. 2002, doi: 10.1613/JAIR.953.

H. He and Y. Ma, “Imbalanced learning : foundations, algorithms and applications,” 2013.

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 50SEA

This work is licensed under a Creative Commons Attribution 4.0 International License.