A Framework for Fraud Detection in Banking Transactions Using Machine Learning and Federated Learning

Keywords:

Deep Learning, Machine Learning, Federated Learning, Fraud Detection, Convolutional Neural Network, Long Short-Term MemoryAbstract

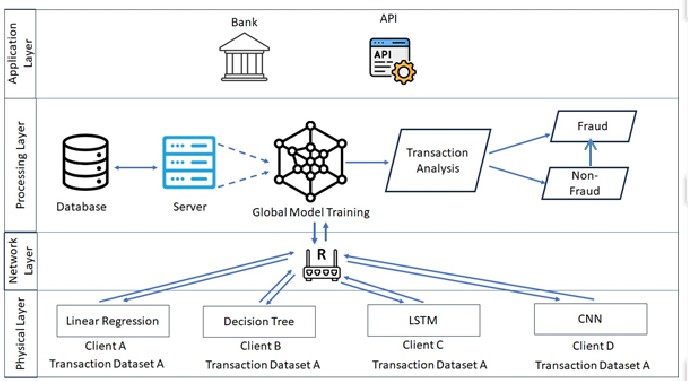

The digital banking revolution has transformed financial services to make payment faster, more convenient, and borderless. But with this revolution came an abrupt increase in fraudulent transactions through credit cards that threatening both the financial institutions and the customers. While conventional fraud detection mechanisms are not capable of addressing new-generation fraud patterns, there is an increasing demand for intelligent, adaptive, and secure solutions with high precision without any data privacy compromise. Proposed model leverages four machine learning models, Linear Regression, Decision Tree, Long Short-Term Memory (LSTM) and Convolutional Neural Network (CNN). LSTM and CNN are used due to their power in learning complicated sequential and feature-based patterns, with Decision Tree and Linear Regression added due to their ease, quick execution, and interpretability. Every model is locally trained on partitioned banking datasets for each simulated client. Model parameters are combined with the Federated Averaging (FedAvg) algorithm to create a globally shared fraud detection system. Experimental testing was conducted on a real-world banking transaction data set published in a non-IID manner to mimic real-world client situations. The federated learning paradigm achieved encouraging results: CNN and LSTM models achieved detection accuracy rates of over 95%, with outstanding performance in the detection of hidden or time-series-based fraud patterns. The Decision Tree model also achieved steady performance at 91% accuracy, and Linear Regression achieved a reasonable baseline at 88%. These results indicate that even simple models, when used in a collaborative federated environment, can contribute meaningfully to fraud detection. This research contributes to the body of research supporting federated banking solutions and fills a significant gap by demonstrating how several ML models can coexist and collaborate in a decentralized setup for fraud detection through credit card transactions.

References

Sharma and A. Panigrahi, “A Review of Financial Accounting Fraud Detection based on Machine Learning Models,” Int. J. Comput. Appl., vol. 39, no. 1, pp. 37–47, 2012.

F. Carcillo, Y. A. Le Borgne, O. Caelen, Y. Kessaci, F. Oblé, and G. Bontempi, “Combining unsupervised and supervised learning in credit card fraud detection,” Inf. Sci. (Ny)., vol. 557, pp. 317–331, May 2021, doi: 10.1016/J.INS.2019.05.042.

J. Jurgovsky et al., “Sequence classification for credit-card fraud detection,” Expert Syst. Appl., vol. 100, pp. 234–245, Jun. 2018, doi: 10.1016/J.ESWA.2018.01.037.

A. Dal Pozzolo, G. Boracchi, O. Caelen, C. Alippi, and G. Bontempi, “Credit card fraud detection: A realistic modeling and a novel learning strategy,” IEEE Trans. Neural Networks Learn. Syst., vol. 29, no. 8, pp. 3784–3797, Aug. 2018, doi: 10.1109/TNNLS.2017.2736643.

H. S. AlSagri, “Hybrid Machine Learning based Multi-Stage Framework for Detection of Credit Card Anomalies and Fraud,” IEEE Access, 2025, doi: 10.1109/ACCESS.2025.3565612.

P. M. Preciado Martínez, R. F. Reier Forradellas, L. M. Garay Gallastegui, and S. L. Náñez Alonso, “Comparative analysis of machine learning models for the detection of fraudulent banking transactions,” Cogent Bus. Manag., vol. 12, no. 1, Dec. 2025, doi: 10.1080/23311975.2025.2474209;WGROUP:STRING:PUBLICATION.

Gupta and M. Mathur, “AI-Powered Fraud Detection in E-Banking,” TAJMEI (UK), vol. 2, no. 8, pp. 22–30, 2022.

Yanto et al, “Fraud Detection Using Deep Learning Techniques in Mobile Banking,” Indones. J. Electr. Eng. Comput. Sci., vol. 26, no. 3, pp. 1361–1381, 2022.

K. Byeon, “A Federated Learning-Based Fraud Detection Framework for Privacy Preservation,” KSII Trans. Internet Inf. Syst., vol. 16, no. 3, pp. 132–144, 2022.

Y. Liu et al, “Artificial Intelligence in Fraud Prevention: Techniques and Challenges,” BDCC, vol. 7, no. 1, pp. 93–112, 2023.

M. Fatima and M. Sharma, “Innovative Approaches to Banking Fraud Prevention Using AI,” Springer Briefs in Cybersecurity, 2023.

J. Z. Haobo Zhang, Junyuan Hong, Fan Dong, Steve Drew, Liangjie Xue, “A Privacy-Preserving Hybrid Federated Learning Framework for Financial Crime Detection,” arXiv:2302.03654, 2023, doi: https://doi.org/10.48550/arXiv.2302.03654.

P. Kamuangu, “A Review on Financial Fraud Detection using AI and Machine Learning,” J. Econ. Financ. Account. Stud., vol. 6, no. 1, pp. 67–77, Feb. 2024, doi: 10.32996/JEFAS.2024.6.1.7

M. M. H. Sizan et al., “Advanced Machine Learning Approaches for Credit Card Fraud Detection in the USA: A Comprehensive Analysis,” J. Ecohumanism, vol. 4, no. 2, pp. 883-905–883 – 905, Feb. 2025, doi: 10.62754/JOE.V4I2.6377.

Olubusola Odeyemi, Noluthando Zamanjomane Mhlongo, Ekene Ezinwa Nwankwo, and Oluwatobi Timothy Soyombo, “Reviewing the role of AI in fraud detection and prevention in financial services,” Int. J. Sci. Res. Arch., vol. 11, no. 1, pp. 2101–2110, Feb. 2024, doi: 10.30574/IJSRA.2024.11.1.0279.

M. Al Marri, A. AlAli, and A. Marri, “Financial Fraud Detection using Machine Learning Techniques Financial Fraud Detection using Machine Learning Techniques Recommended Citation Recommended Citation”, Accessed: Jun. 23, 2025. [Online]. Available: https://repository.rit.edu/theses

“Federated Learning for Privacy-Preserving AI in Financial Fraud Detection | Request PDF.” Accessed: Jun. 23, 2025. [Online]. Available: https://www.researchgate.net/publication/388969456_Federated_Learning_for_Privacy-Preserving_AI_in_Financial_Fraud_Detection

S. Singh and R. Kumar, “Federated Learning with LSTM for Banking Transaction Fraud Detection,” BDCC, vol. 8, no. 6, pp. 1–15, 2024.

K. et Al, “Transforming Banking Security Using ML,” TAJET (USA), vol. 4, no. 20, pp. 20–32, 2023.

N. Kumar and V. Mehra, “Federated Learning in Financial Transactions: Opportunities and Challenges,” J. Mach. Intell., vol. 9, no. 2, pp. 50–64, 2024.

T. Hussain et al, “Data Security and Privacy in Distributed Learning for Financial Systems,” Secur. Priv., vol. 4, no. 2, pp. 1–15, 2023.

R. Pathak and S. Patel, “AI Techniques in Banking Fraud Analysis,” Comput. Intell. Neurosci., vol. 9457381, 2022.

M. Naeem et al, “Federated Deep Learning for Secure Banking Fraud Detection,” Elsevier Procedia Comput. Sci., vol. 213, pp. 123–131, 2022.

L. Tan and M. Islam, “Comparative Evaluation of ML Models for Fraud Detection,” IEEE Trans. Big Data, vol. 8, no. 1, pp. 112–124, 2022.

K. Anand et al, “Federated Learning for Privacy-Aware Fraud Detection,” Sensors, vol. 22, no. 9, pp. 3055–3073, 2023.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 50sea

This work is licensed under a Creative Commons Attribution 4.0 International License.